Home

Golden Royal Technologies

About Us

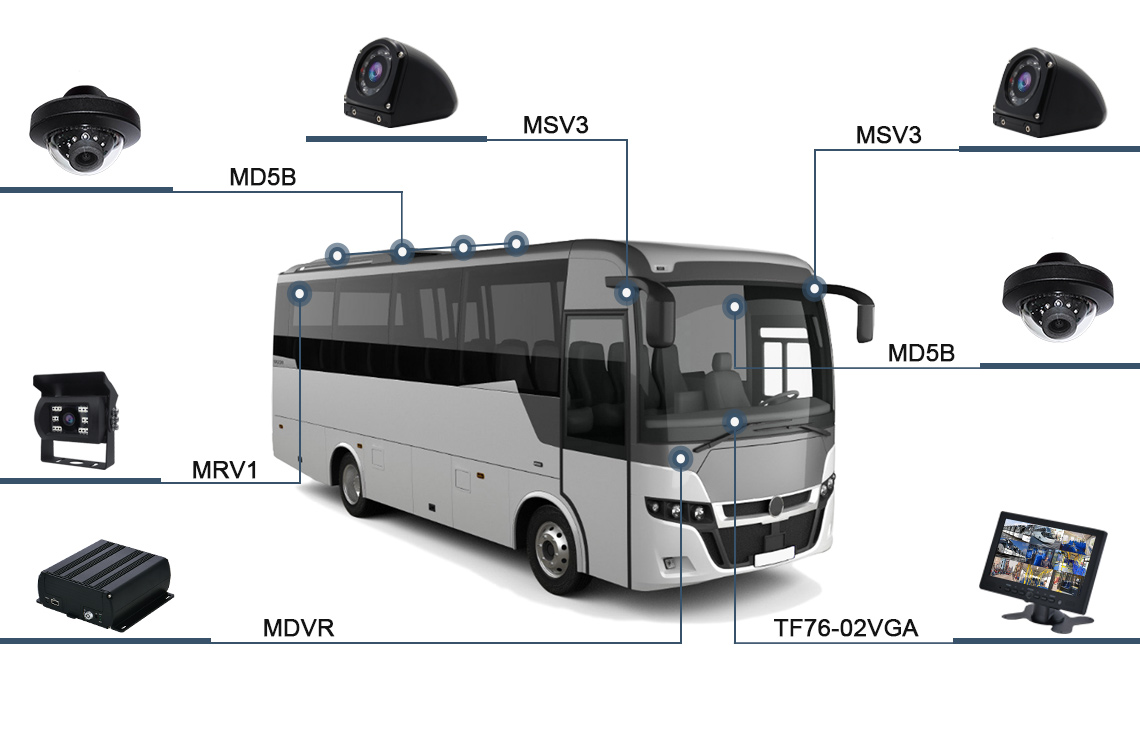

More than just fleet telematics security systems installation provider, Golden Royal Technologies offers a wide range of solutions to support your business and to ensure complete security of your vehicles, home and office.

Solutions include Vehicle and Asset Tracking, Video Telematics for your Vehicles, CCTV Installations, Hidden Cameras Installation, Access Control, Electric Fencing, Boom Gate etc.